Before choosing a system, contact your insurance provider to see what their restrictions are concerning what type of systems make the price cuts. homeowners insurance. Some companies call for totally kept track of security systems, while others merely call for a Wi-Fi system with self-monitoring. The cost savings on the insurance policy costs can dramatically offset or cover the expense of the protection system, so you get 2 benefits for one expense.

If you live near to a fire station, initial responders will certainly arrive swiftly at your residence in case of a fire and also can include as well as extinguish the fire promptly as well as successfully, decreasing damages as well as lowering the expenses to clean up - insurance. Because of this, your premium may be reduced in acknowledgment of the reduced risk.

Coastal homes are beautiful and also relaxing, but they include included risk: Any body of water is a flood threat. Whether it's a stunning stream, a tranquil lake, or a sea in your backyard, distance to water will raise your insurance policy prices. a home. Criterion house owners insurance policy does not cover damages from floodings that are outside the home.

Also if your home isn't in a waterfront or low-lying area, flood insurance coverage can be an excellent investment if the water level in your area are high. The water isn't the only threat to a coastal house, nonetheless. Coastal locations are extra revealed to strong, damaging winds, and also salt spray can trigger steel as well as timber to age faster and stop working sooner, so those threats likewise produce higher rates - a home.

Your credit report score might likewise influence your property owners insurance coverage premium. House owners with reduced credit ratings may have to pay more merely because the insurer concerns them as a larger threat; while this is not necessarily true, it's a fact of the insurance market. condo insurance. Those with higher scores might pay less.

The Ultimate Guide To The Average Cost Of Home Insurance - The Balance

This is just how they make money. They comprehend, obviously, that occasionally asserts MUST be submitted and will not always hold that versus you. If, nonetheless, you're a regular fileryou documents an insurance claim for every single stick that bounces off the roof as well as every decrease of water from a pipeyou might discover that the lower rates are not available to you (property insurance).

Especially damaging are multiple cases of the exact same kind. Your price will not be enormously affected by one weather insurance claim, because that's what house owners insurance is for. A fire insurance claim will certainly have a somewhat bigger effect, however a second fire case (or second or 3rd burglary case) recommends to the insurance provider that you aren't utilizing proper safety preventative measures as well as are at a greater threat for future claims.

Unless your backyard is completely fencedand in some cases also thenthose frameworks can be classified as eye-catching problems. Every youngster who passes by will be attracted to the structures, as well as that makes them a threat (homeowners). As high as we would certainly such as to assume that all kids are gone along with by moms and dads when walking the area, they're children, so sneaking over to try the next-door neighbor's trampoline or water slide in an unguarded moment can be tempting.

Appealing annoyances aren't limited to play structures, either. A recurring construction job with the guarantee of an amazing place to play hide-and-seek, or for grownups, the guarantee of devices and also intriguing conversation pieces, can attract unforeseen or uninvited visitors and trigger a higher rate. Flooding insurance policy is a policy that is frequently added on to your base policy.

If your pet gets on the restricted listing, you can include a recommendation to include coverage of that dog. If the replacement cost of fine jewelry in your house may go beyond the optimum payment from your policy, whether it's an engagement ring or granny's antique breastpin, you can add an endorsement to cover the distinction - affordable.

What Does Homeowners Insurance: Cost And Coverage - Rocket Mortgage Do?

All of these enhancements have an expense, so making great choices about what is covered, what needs to be covered, and what the coverage limit needs to be will certainly help you come to the most effective equilibrium for you - security systems. Where you live can make a considerable distinction in your policy price.

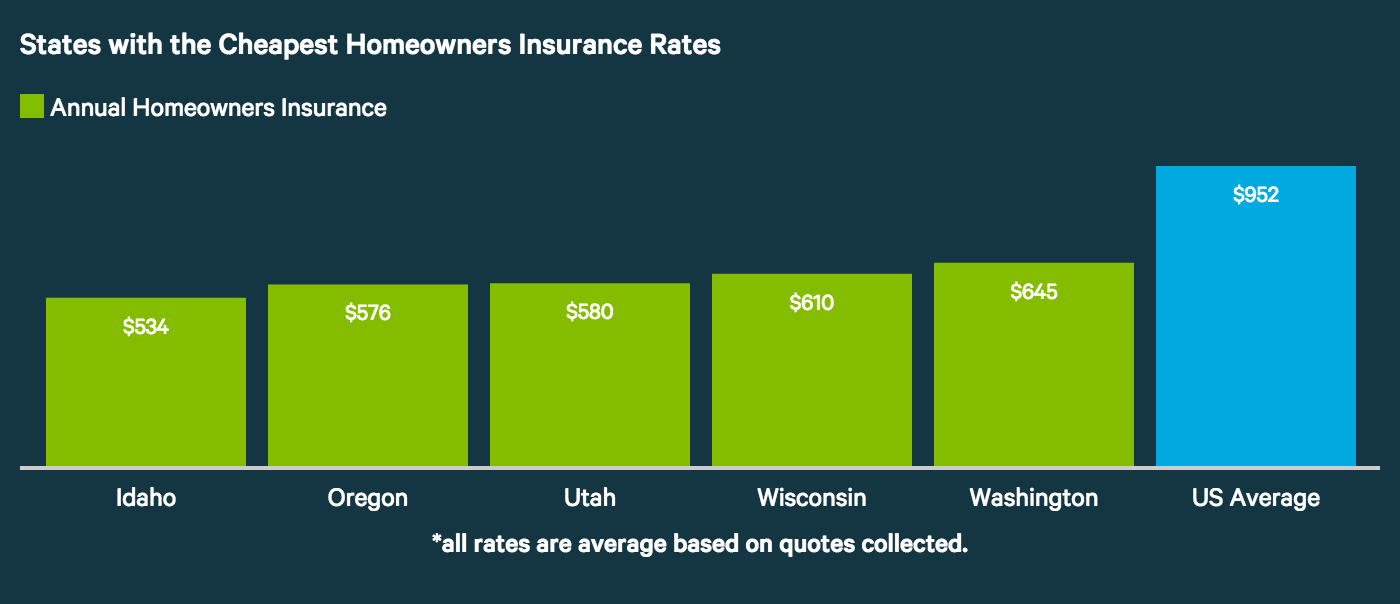

Numerous states have their own insurance standards that determine just how much protection you should bring to secure their own funds in situation of an all-natural catastrophe, as well as those policies will fold up right into your expenses. If you live in a state that is far from where structure materials are generated, those products will certainly cost a lot more in a repair work or rebuild.

Similar to any various other provider, specialist, or loan provider that you select to do business with, it is essential to do your research. Even if your lending institution or real estate agent provides you the names of a few insurance business doesn't imply those firms are best for you. Ask loved ones, look around online, make phone calls, request for quotes, and also examine the business documents of firms you're considering. for home.

Named-peril insurance coverage is restricted to the specific dangers listed in the plan, with any kind of other perils excluded. Open danger is the reverse: All perils are covered, unless they are specifically listed as exclusions. This can be a little confusing, so it's essential to read your strategy documents carefully as well as ask your insurance firm for clarification before signing.

One of the most extensive coverage choice, HO-5 coverswell, every little thing that is not omitted. It consists of insurance coverage for all risks that are not named as exclusions (such as damage triggered by overlook) for your home, outhouses, and personal effects - a home. Targeted at condo owners, who have different demands from both house owners and tenants, HO-6 supplies named-peril coverage for damage to the inside, personal effects, individual liability, as well as visitor medical repayments, along with loss of use as well as added living expenditures, yet it does not cover the framework of the structure.

The Best Strategy To Use For Veterans' Mortgage Life Insurance (Vmli)

It has a different set of parameters, nonetheless, as it's meant for mobile home residents and includes coverage that is particular to manufactured and mobile houses. Has your house been decreased for home owners protection because it's as well high-risk? HO-8 insurance coverage will certainly provide the specific perils you're covered for as well as supply risk protection just for your home as well as personal things.

Even if you don't have a home mortgage, a residence as well as lawn that are uninsured are like an invitation to insolvency and also monetary ruin. It's fantastic to have a reserve for unforeseen repairs and upkeep, however many people do not have the resources to pay out of pocket for a house that is completely ruined by fire or collapseespecially when you take into consideration the price of the preparation, allows, teardown as well as haul away of the previous home, products, home furnishings, and all of the individual home that was lost, together with the price to live somewhere else for months while the reconstruct is finished.

Ask regarding bundling your property owners policy with life insurance coverage as well as vehicle insurance coverage at the same insurer. Gather at the very least 3 house insurance coverage quotes to contrast insurance coverage and also expense.

It's vital to both the protection of your house as well as wallet to ask questions as well as make sure you truly get the coverage you require. Here are solution to a few of one of the most usual inquiries and their answers (security systems). The national standard is $1,300 to $1,500 per year, however this will certainly vary significantly based on place, the size and also specifics of your home, and also just how much coverage you choose.

Are there proprietor insurance policy discounts? Discount rates exist, but it's not as deal-driven as various other types of coverage like vehicle insurance coverage.

Getting My Florida Blue: Florida Health Insurance Plans To Work

Package landlord insurance policy for all your services with the exact same firm to decrease your premium on each plan. Does my home owner's insurance coverage policy cover my rental property?

Rental building insurance policies cover houses, and also tenants insurance policy plans shield your tenants' individual possessions and obligation. Lots of property owners need their occupants to buy occupants insurance because it reduces headaches when individual home claims develop.

landlord cheapest insurance a home owners insurance homeowners homeowner insurance

landlord cheapest insurance a home owners insurance homeowners homeowner insurance

As well as proprietors demand lessees buy tenants insurance to shield the renters after a major case. The renter's policy would certainly cover that for them, while your property owner insurance policy compensated you for your loss of rental earnings while the residence is made livable.

This 3,700 square-foot apartment with 3 rentals exists near downtown Chicago on Fullerton Opportunity. security systems. It last cost $950,000 in 2018, and the proprietor believes its substitute price would certainly have to do with $740,000 at $200 per square foot. It's completely leased and also generating a month-to-month rental earnings of $6,000.

Last, the liability insurance policy sets you back $350 for $1m in liability protection as well as $5,000 in clinical settlements for occupants and their guests. What's incorrect with this example, The owner thinks that his proprietor insurance policy coverage safeguards against just regarding anything that can happen to his residential or commercial property, and also he's in good condition.

Facts About for home insurance How Much Does Homeowners Insurance Cost? - Lemonade Uncovered

a home insurance insurance insurance premium landlord a home

a home insurance insurance insurance premium landlord a home

lowest homeowners insurance cheapest insurance deductibles for home cheapest homeowners insurance

lowest homeowners insurance cheapest insurance deductibles for home cheapest homeowners insurance

Allow's say the owner installed a roof covering, and also it sets you back $40,000 that's the replacement expense. However he installed the roof in 1999, so by currently, it's acquired $18,000 in depreciation. The Actual Cash money Value is currently only $22,000; that's the substitute expense of $40k minus $18k in devaluation.

homeowners home insurance cheapest homeowners insurance liability insurance insurance claims

homeowners home insurance cheapest homeowners insurance liability insurance insurance claims

It worsens. The proprietor has a deductible of $2,500. The owner will certainly finish up with a check for only $19,500 to change a roofing system that will cost $40k. The owner must most likely get a brand-new quote where the evaluation approach is "Replacement Price" instead of "Actual Cash Money Worth."A Pointer For Future Landlords, We spoke to a real estate financier and he shared an insight on exactly how he utilizes proprietor insurance policy for the residential or commercial properties that he fixes up that he leases to lessees in the future.

You require what is called a vacant policy which as you can picture is extra pricey due to the fact that statistically, a vacant residential property is much extra likely to sue. We utilize a vacant policy after we have actually finished building and construction and are waiting to put a lessee. After the renter has moved in we transform the plan to a property owner plan which is less costly. homeowner insurance cheaper.

Unless you operate in the insurance market, you probably have a great deal of concerns about buying a house owners insurance plan. Recognizing more concerning your options, how insurance coverage firms run as well as exactly how house insurance coverage estimates job aids you get the very best possible offer. a home insurance. The conventional home owners insurance plan is fairly intricate, however purchasing one does not have actually to be complicated.

landlord insurance premium property insurance insurance premium deductible

landlord insurance premium property insurance insurance premium deductible

g., "What does house insurance coverage cover?" "Just how much home insurance do I need?"), collecting significant details like quotes and also evaluating your choices (condo insurance). While a few of the following points might not relate to you, this house insurance coverage overview supplies a generalized strategy to assessing and also choosing the most effective residence insurance for you.

Everything about How Much Does Home Insurance Cost? - Gocompare

The conventional home owners insurance plan additionally protects the house owners from responsibility. Their mortgage lender needs that they lug it, They need obligation defense, They need a means to reconstruct or repair their home after destruction by a protected reason like a fire, They need a method to replace their personal belongings if they're ruined by a protected cause or swiped, Without home insurance coverage, proprietors could deal with high repair costs.